Neighborhood Spotlight: Sellersville, PA

What to do; Where to dine and shop; & What you don’t want to miss

Sellersville was founded in Bucks County in the early part of the 18th century. At first, it was known for its large inn and the town was called Sellers Tavern. The area started to grow with the introduction of the North Pennsylvania Railroad in the 1860s and developed into Sellersville.

The Vibe

The overall vibe of Sellersville is suburban with a small-town ambiance and strong sense of community. It’s mostly residential with a Main Street that boasts several shops and attractions. The local firehouse hosts many events during the year, including a town carnival.

Where to Eat and Drink

Sellersville features several restaurants that offer great service and tasty meals, so you can always find something to suit your appetite.

- Washington House Hotel and Restaurant — This cozy hotel is a local icon, offering incredible food and charming hospitality. There’s a pretty outdoor seating area if you’re in the mood to dine al fresco or sip on a refreshing mimosa. In the evening, indulge in a delicious dinner before retreating to your room for a relaxing rest.

- Chiaro’s Pizzeria and Restaurant — This pizzeria makes everything from scratch using fresh ingredients. Taste authentic Italian cuisine, dig into a cheesy pizza, or skip the meal and treat yourself to a decadent dessert.

- J.T. Bankers — The name of this restaurant stands for Just Three Bankers because the original three partners worked together at a local bank in Willow Grove. The restaurant aims to serve delicious food with great service in a friendly atmosphere. Affordability is also important, and the eatery offers programs that give guests opportunities to earn free drinks and food.

- A & N Diner — This classic American diner is a favorite of locals searching for a relaxing, casual place to find a tasty breakfast, lunch, or dinner. Come with an appetite, because they serve generous portions.

Where to Shop

See what treasures you can discover exploring these local shops in Sellersville, Pennsylvania.

- The Wax Cauldron — Step into this cute local boutique for hand-poured candles, artwork, wax melts, crystals, home decor, and much more. Learn about aromatherapy and how it can benefit your life.

- Just One More Plant — This family-owned business focuses on houseplants and anything you would need to help them thrive. Check out pottery, soil and supplies, and a variety of plants to add fresh greenery to your home.

- Pink City Thrift Store and Nursery — 608 S Main St, Sellersville, PA 18960 —100% of the profits from this local thrift shop go to breast cancer research and awareness. Discover fun finds, home accessories, vintage pieces, and plants for sale as you browse.

Three Things You Shouldn’t Miss

Whether visiting the local museum or testing your athletic skills, Sellersville offers a few enticing attractions to enhance your visit.

- Sellersville Theater 1894 — Get ready for a night of entertainment in this historic building next to the Washington House. The 325-seat venue showcases live music, comedy shows and more from local performers. It also features national and international entertainers.

- Sellersville Disc Golf Course — If you’re a fan of disc golf or curious about the game, this local park features a course complete with elevation, water, and other interesting features. There are 18 holes, ranging from under 300 feet to over 400 feet.

- The Sellersville Museum — Learn about the local history of Sellersville with a visit to the town’s museum. Discover stories of the past and enjoy rotating exhibits of all kinds. The museum is free thanks to knowledgeable and dedicated volunteers. The hours can shift depending on when people are there to help, so check before you go.

Get to know more about Sellersville, learn about the area, and discover other ways to enjoy your time in town. Happy exploring!

For more Neighborhood Spotlights, click here: https://cbhre.com/category/neighborhoodspotlight

Interested in other blogs? Check this out: https://cbhre.com/blog

August 2024 Market Statistics

Local Real Estate Market Snapshot

Bucks County

Bucks County has seen a significant increase in inventory, with a 36.5% rise year-over-year, bringing available homes to 980 in August 2024 compared to 718 in 2023. Despite more available homes, sold units dropped by 5.9%, with 603 homes sold. Pending contracts rose by 8.2%, signaling a potential increase in future sales.

Median sold prices increased by 7.9%, now at $510,000. Homes are moving slightly faster with an average of 26 days on market (CDOM) compared to 28 last year, and sellers are getting close to their asking prices, with the list-to-sold price ratio at 96.0%, a slight drop from 97.2% in 2023.

Montgomery County (Montco)

Montgomery County experienced a 27.8% rise in inventory, reaching 1305 homes, alongside a 9.3% increase in sold units (897 homes). Pending contracts also saw a 2.1% uptick, showing a steady flow of buyer activity.

Median sold prices increased by 3.2%, now at $465,000, with homes taking slightly longer to sell at 30 days, up from 28. The sold-to-list price ratio dipped to 94.8% from 97.6%, reflecting slightly less seller leverage.

Chester County

In Chester County, inventory rose by 26.1% to 908 homes, though the number of sold units dropped by 8.1% to 569. Pending contracts decreased by 6.4%, indicating a slight slowdown in future sales.

Median home prices showed a small increase of 0.9% to $535,000. Homes sold in an average of 24 days, slightly faster than the previous year. The sold-to-list price ratio remained unchanged at 98.1%, indicating a stable seller’s market.

Berks County

Berks County reported a 4.8% increase in inventory, reaching 417 homes, with sold units rising by 2.5% to 410 homes. Pending contracts also rose by 3.1%, suggesting steady demand.

Home prices increased by 7.6% to $285,300. The average days on market increased slightly to 24 days, and the sold-to-list price ratio dropped to 98.2%, down from 100.0% last year.

Northeast Philadelphia (NEPHL)

NE Philadelphia saw a 12.4% increase in inventory, with 500 homes available, but a 5.0% decline in sold units to 247 homes. Pending contracts grew by 2.9%, indicating a potential increase in sales soon.

Median sold prices increased by 5.6% to $290,000. Homes are selling faster, with the average days on market dropping to 31 days from 36. The sold-to-list price ratio inched up to 96.6% from 96.4%.

Mercer County

Mercer County was a standout performer, with a 23.5% increase in inventory, reaching 689 homes. However, sold units decreased by 9.4% to 317 homes. Pending contracts showed strong growth, rising by 18.4%, signaling a potential uptick in future sales.

Home prices jumped by 10.0%, reaching a median of $467,000. Homes sold faster, with an average of 29 days on the market, and the sold-to-list price ratio improved to 98.9%, reflecting strong demand.

Greater Lehigh Valley Region (GLVR)

GLVR saw a 12.0% increase in inventory, with 768 homes available, but sold units declined by 9.7%. However, pending contracts rose by 7.9%, suggesting potential growth in sales.

The median sold price increased by 4.2% to $345,000, with homes taking an average of 16 days to sell. The sold-to-list price ratio remains strong at 101.1%, though it has dropped slightly from 102.4% in 2023.

Month-Over-Month Updates for Southern New Jersey Areas

Cape May County, NJ

Cape May County’s market continues to heat up. The median sold price increased significantly by 29.92%, reaching $692,500 in August 2024. Homes sold jumped by 25%, with 30 homes sold compared to the previous month. Inventory also increased by 11.5%, with 97 active listings, giving buyers more options.

Homes are selling faster, with the average days on market (CDOM) dropping by 25% to 24 days. The list-to-sold price ratio improved to 98.4%, up by 1.55%, showing that sellers are receiving offers close to their asking prices.

Ocean County, NJ

In contrast, Ocean County saw a slight cooling. The median sold price dropped by 2.11%, settling at $465,000. The number of homes sold also decreased by 1.9%, with 858 homes sold in August 2024. Active listings experienced a significant decrease of 21.8%, bringing the total to 5,219 homes.

Homes are staying on the market slightly longer, with the average DOM increasing by 4% to 26 days. The list-to-sold price ratio dropped in line with median prices, reflecting a softening market.

Atlantic County, NJ

Atlantic County’s market showed a mix of positive and negative changes. The median sold price surged by 11.03% to $365,300, while the number of homes sold dipped by 1.1% to 271. Inventory increased by 5.6%, with 1,042 active listings.

Homes are taking longer to sell, with the average DOM rising by 13.04% to 26 days. Despite this, the list-to-sold price ratio improved to 99%, up by 0.72%, reflecting continued buyer interest.

Market Summary by Category

Across all these regions, there are a few key trends to note:

- Inventory: Inventory levels have generally increased in most areas, providing more options for buyers. The exception is Ocean County, where a significant drop in active listings was observed.

- Sold Units: Year-over-year trends showed declines in sold units across many regions, though some areas like Cape May and Montco posted monthly or annual increases.

- Median Sold Pricing: Price growth was a common theme across most markets, with the highest increase in Cape May County. Ocean County was the only exception, with a slight drop in median pricing.

- Days on Market: In most areas, homes are moving quickly, with some regions like Cape May and Mercer showing reduced DOM. Ocean and Atlantic Counties saw slight increases in selling times.

- List-to-Sold Price Ratio: While many regions reported slight declines in sold-to-list price ratios, several areas like Cape May, Atlantic County, and Mercer saw improvements, indicating continued demand.

These insights offer a comprehensive look at the real estate market across various counties in Pennsylvania and New Jersey as of August 2024, helping both buyers and sellers navigate a complex and shifting landscape.

Compare to last month’s market, HERE!

Preparing Your Landscape for Fall

End of Summer Yard Clean-Up

As we step into September, the first hints of autumn start to appear. While the full blaze of fall colors is still a few weeks away, now is the perfect time to get a head start on your yard clean-up. Tackling these early tasks will set the stage for a beautiful and healthy landscape throughout the season. Here’s how to make the most of this first week of September.

1. Inspect Your Trees and Shrubs

Before the leaves begin to fall, take some time to inspect your trees and shrubs. Look for any signs of disease, damage, or overgrowth that might need attention. Pruning dead or damaged branches now will help prevent problems during the harsher winter months. Additionally, trimming back any overgrown shrubs will encourage healthy growth and maintain a tidy appearance.

2. Start Clearing Out Garden Beds

As summer flowers begin to fade, it’s a good idea to start clearing out your garden beds. Remove spent annuals and cut back perennials that have finished blooming. This will help prevent diseases and pests from overwintering in your garden. If you have any early-falling leaves, begin raking them up to keep your beds tidy and allow your fall plants to shine.

3. Feed Your Lawn

Early September is an ideal time to give your lawn a boost with a fall fertilizer. Cooler temperatures allow grass to absorb nutrients more effectively, helping to strengthen roots and prepare for the winter months. A well-fed lawn now will be better equipped to bounce back in the spring.

4. Plant Fall Flowers and Bulbs

If you want a burst of color in your yard this autumn, now is the time to plant fall flowers like mums and pansies. September is also a great time to plant spring-blooming bulbs, such as tulips and daffodils. By getting them in the ground early, you’ll ensure they establish strong roots before the winter frost.

5. Start Composting

With leaves and garden debris starting to accumulate, consider starting a compost pile. Composting is an eco-friendly way to recycle yard waste and create nutrient-rich soil for your garden. Starting your compost now means you’ll have a good supply ready for next spring’s planting.

6. Check Your Gutters and Downspouts

While it’s not a task everyone loves, checking your gutters and downspouts in early September can save you headaches later. Clear out any debris that may have accumulated over the summer, and ensure your downspouts are directing water away from your foundation. This will help prevent water damage as fall rains begin.

Ready For Fall!

By tackling these tasks in the first week of September, you’ll not only keep your yard looking its best, but you’ll also lay the groundwork for a healthy and vibrant landscape come spring. Happy gardening!

Visit HERE for more Home Tips & Tricks!

Click HERE to view the rest of our blogs!

July 2024 Market Statistics

July 2024 Real Estate Market Update: Trends Across Pennsylvania and New Jersey

As we step into the second half of 2024, the real estate markets across several counties in Pennsylvania and New Jersey present a mixed bag of trends. From rising median prices to fluctuating inventory levels, here’s a detailed look at the performance across these regions for July 2024.

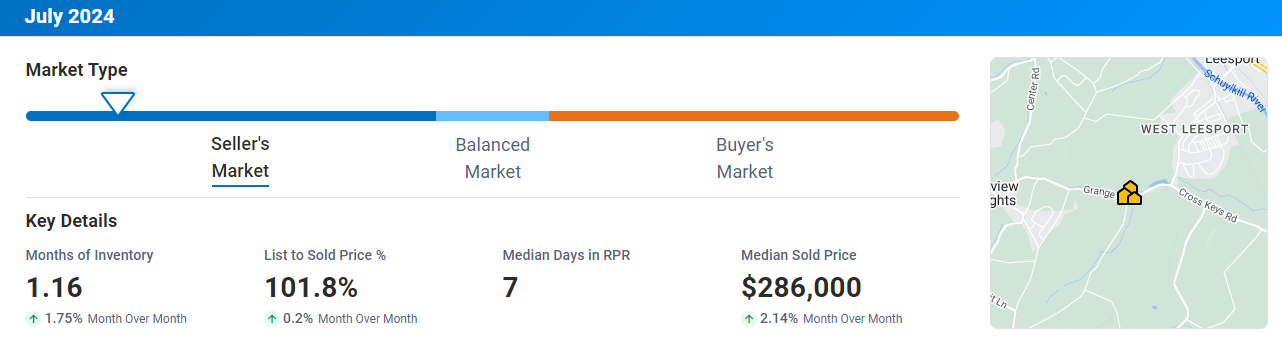

Berks County, PA

Berks County saw a modest increase in its median sold price, which climbed to $286,000, marking a 2.14% rise month-over-month (mo/mo). A total of 361 homes were sold, reflecting a 2.8% increase from the previous month. The number of active listings also grew, with 390 properties on the market, a 4% rise. Notably, homes in Berks County continue to sell quickly, with a median of just 7 days on the market. The list-to-sold price ratio is robust at 101.8%, up 0.2% mo/mo, indicating a strong seller’s market.

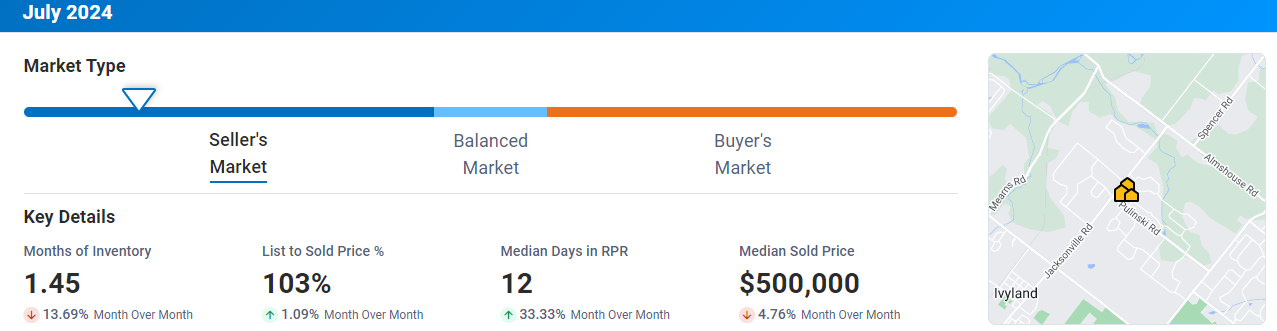

Bucks County, PA

Bucks County experienced a notable drop in its median sold price, which fell by 4.76% to $500,000. Despite this, the market remained active, with 599 homes sold—a significant 16.8% increase mo/mo. Active listings, however, declined by 12.5%, leaving 678 homes available. The median days in RPR increased to 12, a 33.33% jump. Sellers are still seeing high returns, with a list-to-sold price ratio of 103%, up 1.09% mo/mo.

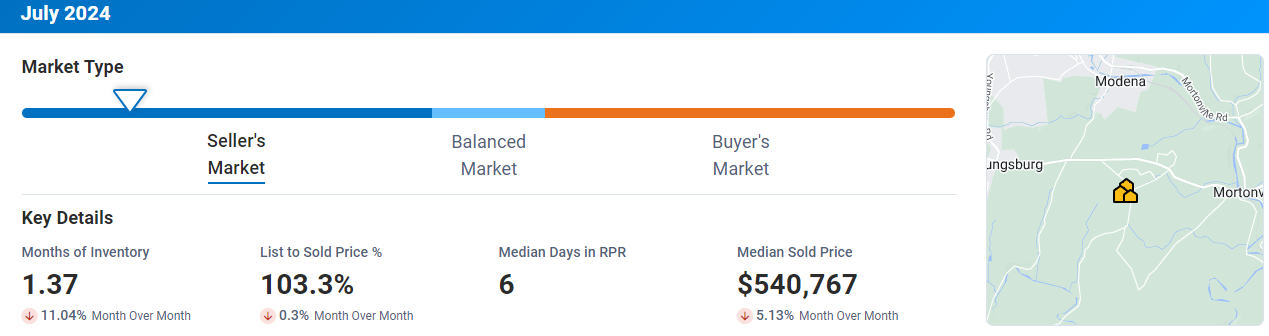

Chester County, PA

In Chester County, the market showed signs of cooling off. The median sold price decreased by 5.13% to $540,767, and the number of homes sold dropped by 10.9% to 540. Active listings fell by 9.2%, leaving 603 homes on the market. Despite these declines, homes are moving quickly, with a median of just 6 days on the market. The list-to-sold price ratio remains strong at 103.3%.

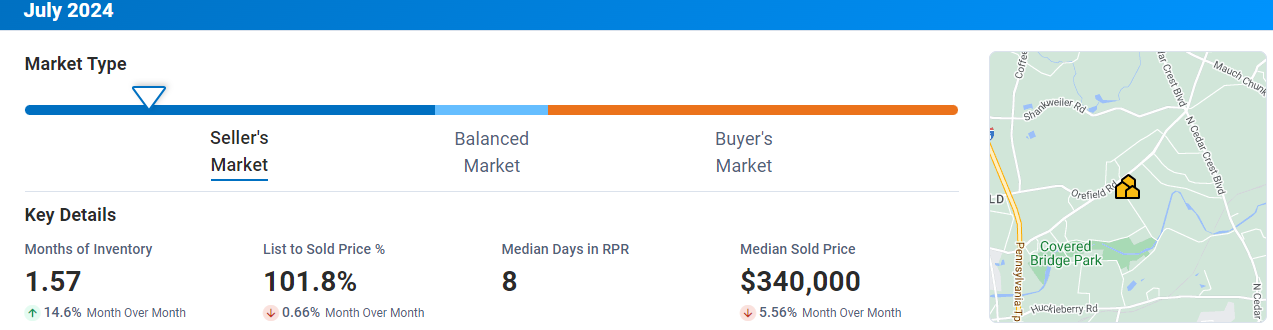

Lehigh Valley, PA

Lehigh Valley’s real estate market also saw a decline in July. The median sold price dropped by 5.56% to $340,000, with 337 homes sold, down 6.6% from the previous month. Active listings increased by 16.4%, bringing the total to 490. Homes spent a median of 8 days on the market, and the list-to-sold price ratio slightly decreased to 101.8%, down 0.66%.

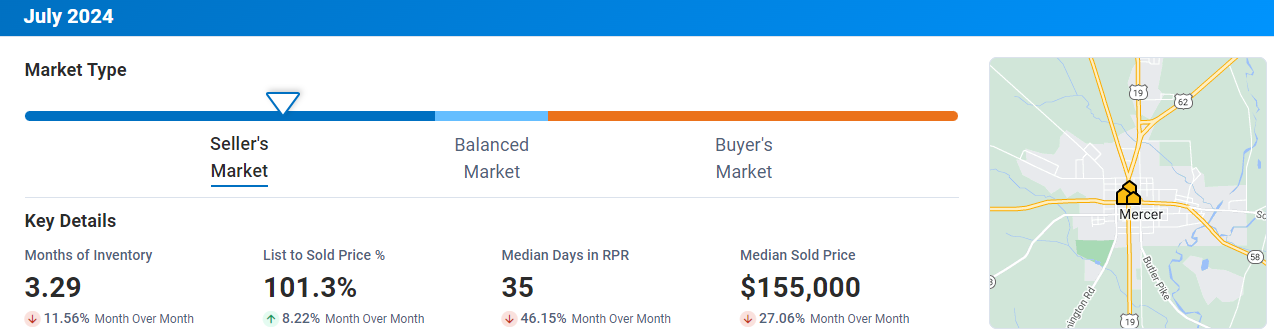

Mercer County, NJ

Mercer County faced a significant decline in its median sold price, plummeting by 27.06% to $155,000. However, the number of homes sold increased by 25% to 5. Active listings dropped by 14.8% to 23. The median days in RPR also fell sharply by 46.15%, now at 35 days. Despite the price drop, the list-to-sold price ratio surged by 8.22%, reaching 101.3%.

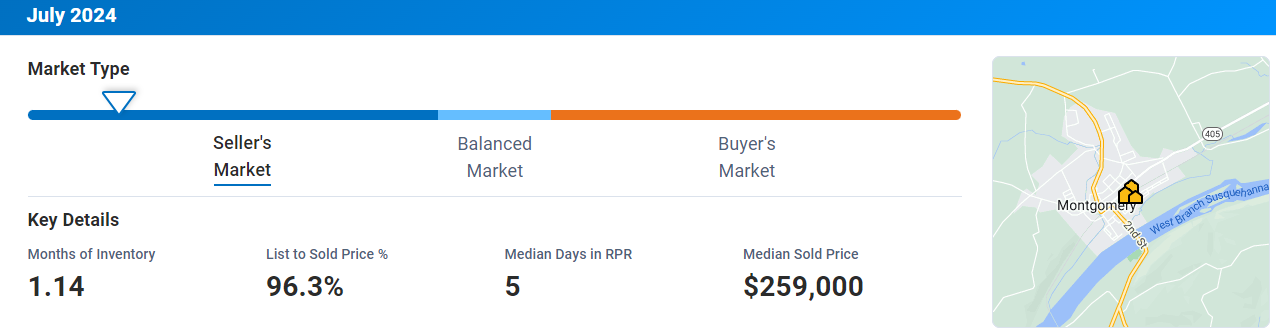

Montgomery County, PA

Montgomery County remained relatively stable, with a median sold price of $259,000. The number of homes sold jumped significantly by 150% to 5, while active listings stayed at 3. Homes sold quickly with a median of 5 days on the market, though the list-to-sold price ratio was 96.3%.

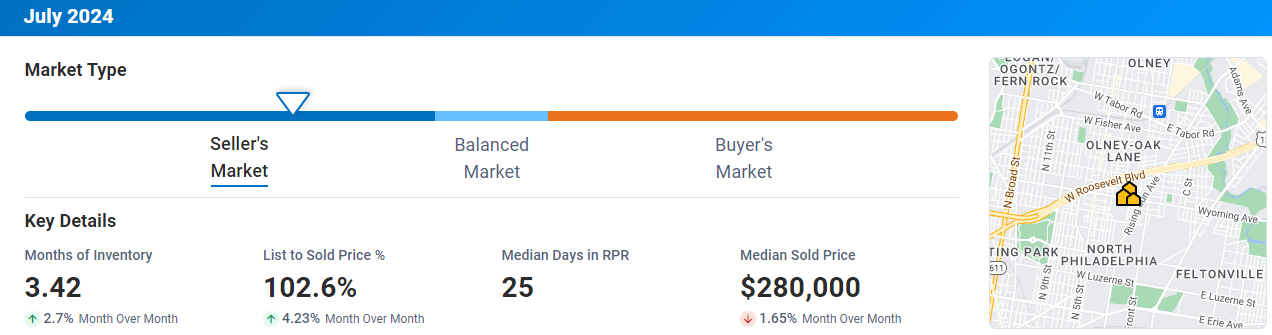

Philadelphia, PA

In Philadelphia, the median sold price slightly decreased by 1.65% to $280,000. The number of homes sold also saw a small decline of 1.5%, with 1,213 transactions. Active listings grew by 4.4% to 3,961. The median days in RPR stood at 25, and the list-to-sold price ratio increased by 4.23% to 102.6%, suggesting competitive bidding.

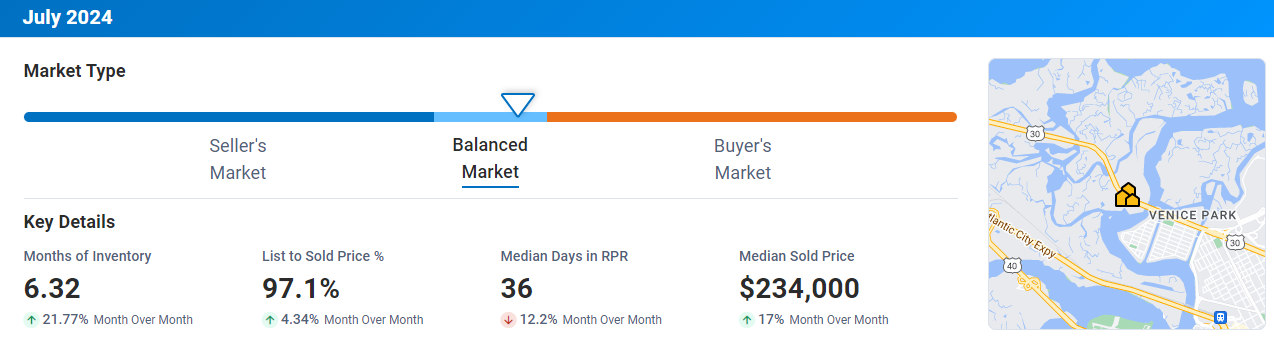

Atlantic County, NJ

Atlantic County experienced a strong increase in its median sold price, which rose by 17% to $234,000. However, the number of homes sold dropped by 40% to 21. Active listings rose by 15% to 238, while the median days in RPR decreased by 12.2% to 36 days. The list-to-sold price ratio also improved, up 4.34% to 97.1%.

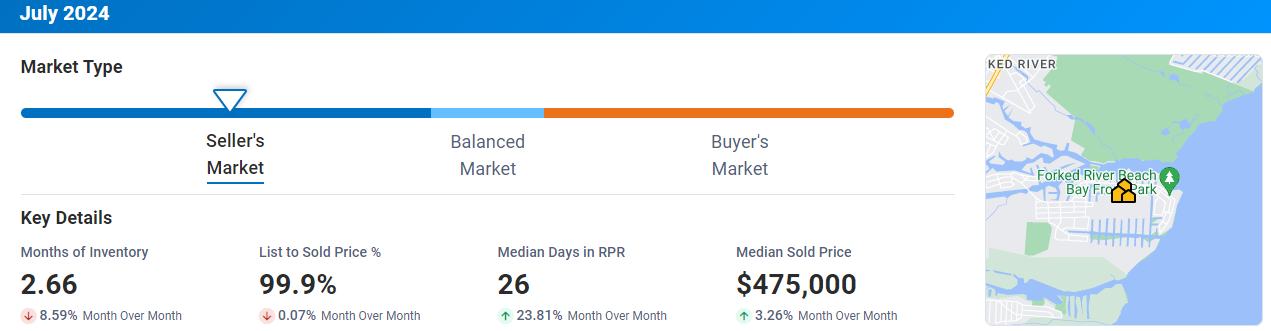

Ocean County, NJ

Ocean County’s market showed positive trends, with the median sold price increasing by 3.26% to $475,000. The number of homes sold went up by 6.5% to 847, while active listings fell by 7.2% to 2,202. The median days in RPR increased by 23.81% to 26 days. The list-to-sold price ratio slightly decreased by 0.07% to 99.9%.

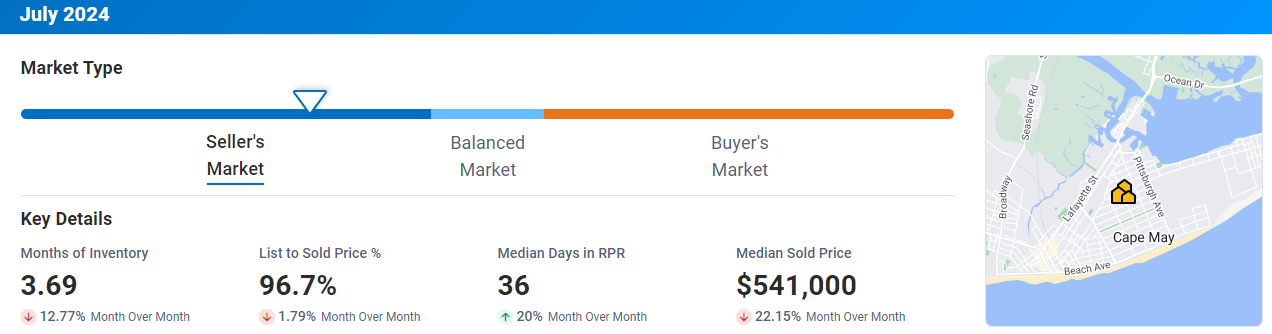

Cape May, NJ

Cape May saw a significant drop in its median sold price, which fell by 22.15% to $541,000. The number of homes sold also declined by 12.5% to 21. Active listings decreased by 8.8% to 83, and the median days in RPR increased by 20% to 36 days. The list-to-sold price ratio fell by 1.76% to 96.7%.

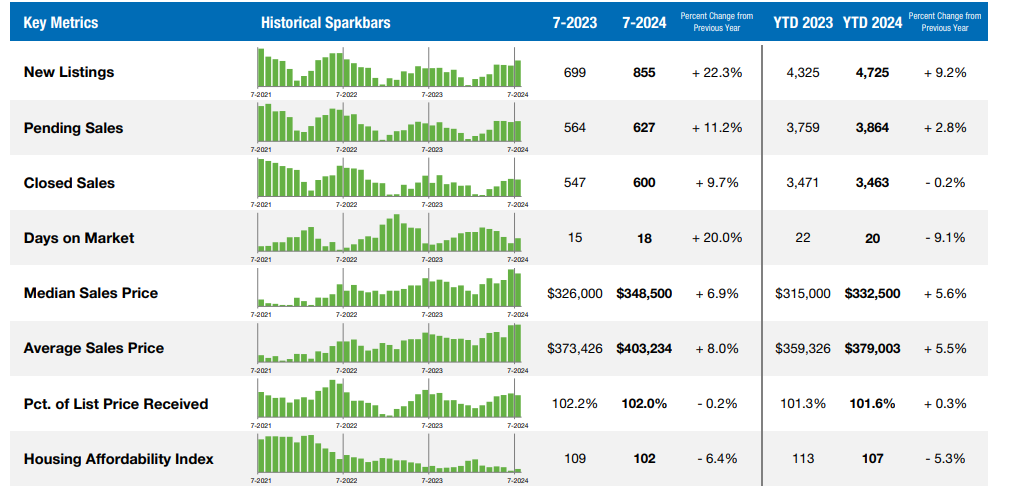

Greater Lehigh Valley REALTORS® (GLVR)

The GLVR market showed growth with a 6.9% increase in the median sold price, reaching $348,500. Homes sold went up by 9.7% to 600, and active listings surged by 19.3% to 802. The average days on the market rose by 20% to 18 days. The list-to-sold price ratio slightly decreased by 0.2% to 102%.

These figures highlight the dynamic nature of the real estate markets in Pennsylvania and New Jersey. While some areas are seeing price drops and slower sales, others continue to experience robust demand and quick turnovers. Keeping an eye on these trends will be crucial for both buyers and sellers in navigating the market as we progress through 2024.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link