January 2025 Market Statistics

The real estate market in Pennsylvania and New Jersey saw a mix of rising home prices, shifting inventory levels, and changes in buyer behavior throughout January 2025. While some counties experienced strong price growth, others saw slower sales and longer days on the market. Here’s a closer look at the trends across key regions.

Bucks County, PA

Bucks County led the region in price appreciation, with the median home price jumping 15.1% to $495,000 year-over-year. The market remained active, with 346 homes sold, up 7.5% from last year. Inventory increased, with 519 active listings, reflecting a 9% gain. Despite a rise in available homes, demand kept pace, as the median days on market remained unchanged at just 12 days. The list-to-sold price ratio stayed firm at 99.5%, keeping sellers in a strong negotiating position.

Montgomery County, PA

Montgomery County saw modest price growth, with the median sold price rising 1.9% year-over-year to $436,000. Buyer activity was strong, with 512 homes sold, marking an 11.3% increase. Inventory remained stable, with 713 active listings, down only 0.3%. Homes are taking longer to sell, as the median days on market increased by five days to 15. Despite this, sellers are still closing deals at 99.3% of asking price, indicating a balanced market.

Berks County, PA

Berks County’s market remained competitive, with the median sold price climbing 11.8% year-over-year to $280,000. Sales activity was nearly unchanged, with 232 homes sold, down just 0.9%. Inventory expanded, with 338 active listings, an 8.3% increase. Homes are still selling relatively quickly, though the median days on market increased by four days to 13. Sellers remain in control, with the list-to-sold price ratio at 100.3%, showing that many homes are selling at or above asking price.

Philadelphia (PHL)

Philadelphia saw a slight dip in median home prices, down 0.5% year-over-year to $250,000, but demand remained steady. The number of homes sold increased by 4.5%, reaching 877 transactions. Inventory remained stable, with 3,786 active listings, up 0.5%. Homes are moving more quickly, as the median days on market dropped by four days to 32. Sellers are still seeing strong offers, though the list-to-sold price ratio sits at 97.8%, indicating buyers may be negotiating slightly more than in other markets.

Chester County, PA

Chester County’s market remained strong, with the median home price rising 5.7% year-over-year to $510,000. Buyer activity was consistent, with 315 homes sold, up 1%. Inventory grew, with 568 active listings, a 19.1% increase. Homes are still selling quickly, as the median days on market dropped by one day to 11. Sellers continue to benefit, with the list-to-sold price ratio holding at 100%, meaning homes are selling at full asking price.

Greater Lehigh Valley (GLVR)

The Greater Lehigh Valley market showed continued strength as home prices rose 8.6% year-over-year to a median of $315,000. Buyer demand remained solid, with 396 homes sold, a 7% increase compared to last year. However, inventory tightened slightly, with 554 active listings, marking a 3.1% decrease. Homes are taking longer to sell, with the median days on market increasing by 19% to 25 days. Despite rising prices, sellers are adjusting slightly, with the list-to-sold price ratio declining to 99.5%.

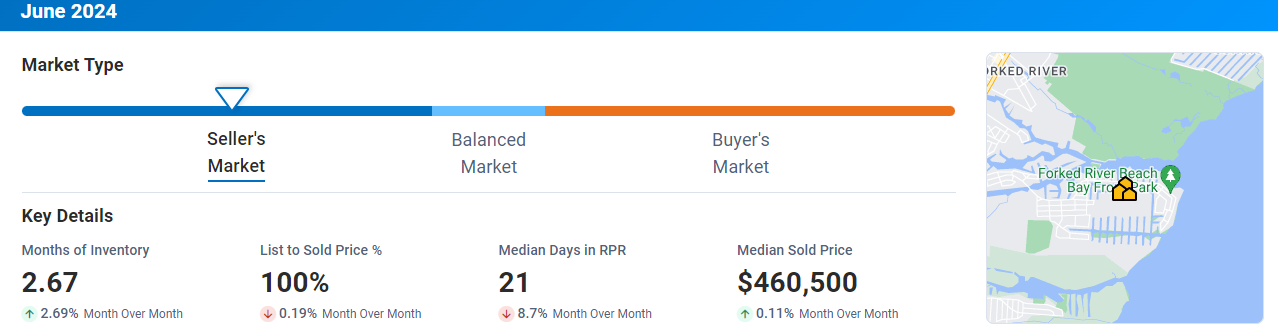

Ocean County, NJ

Ocean County’s market continues to favor sellers, with the median sold price rising 10% year-over-year to $494,900. However, home sales declined by 13.7%, with only 120 homes sold, suggesting buyers may be hesitating at higher price points. Inventory remains steady, with active listings up slightly by 1.3% to 377 homes. Homes are taking a bit longer to sell, as the median days on market increased by four days to 24. The list-to-sold price ratio stands strong at 100.4%, meaning sellers are still achieving top dollar for their properties.

Mercer County, NJ

Mercer County experienced a 5.8% increase in median home prices, reaching $407,500. However, sales activity slowed slightly, with 177 homes sold, down 1.7% from last year. Inventory is growing, with active listings increasing by 20.7% to 373, giving buyers more options. The market is shifting, as homes are now taking a median of 30 days to sell, up 14 days compared to last year. Sellers are still receiving competitive offers, with the list-to-sold price ratio holding at 99.6%.

Hunterdon County, NJ

Hunterdon County saw the most dramatic price increase, with the median sold price skyrocketing 57.8% year-over-year to $915,000. Sales activity surged as well, with 11 homes sold, marking a 57.1% increase. Inventory, however, declined slightly, with 37 active listings, down 9.8%. Homes are taking longer to sell, with the median days on market rising by eight days to 32. Sellers are still commanding strong offers, with the list-to-sold price ratio at 99.1%.

Market Outlook for 2025

As we move into 2025, home prices remain strong across most counties, with rising values in Bucks, Hunterdon, and Ocean Counties. However, sales volume is declining in several areas, and homes are beginning to take longer to sell, signaling a potential market shift. Inventory levels are mixed, with some areas seeing increases that could benefit buyers in the coming months.

Overall, sellers are still receiving strong offers, with list-to-sold price ratios holding above 99% in most regions. While buyers may be gaining a slight advantage in terms of negotiating time, the market remains competitive. If you’re considering buying or selling, staying informed about these trends will be key to making the right move in 2025.

August 2024 Market Statistics

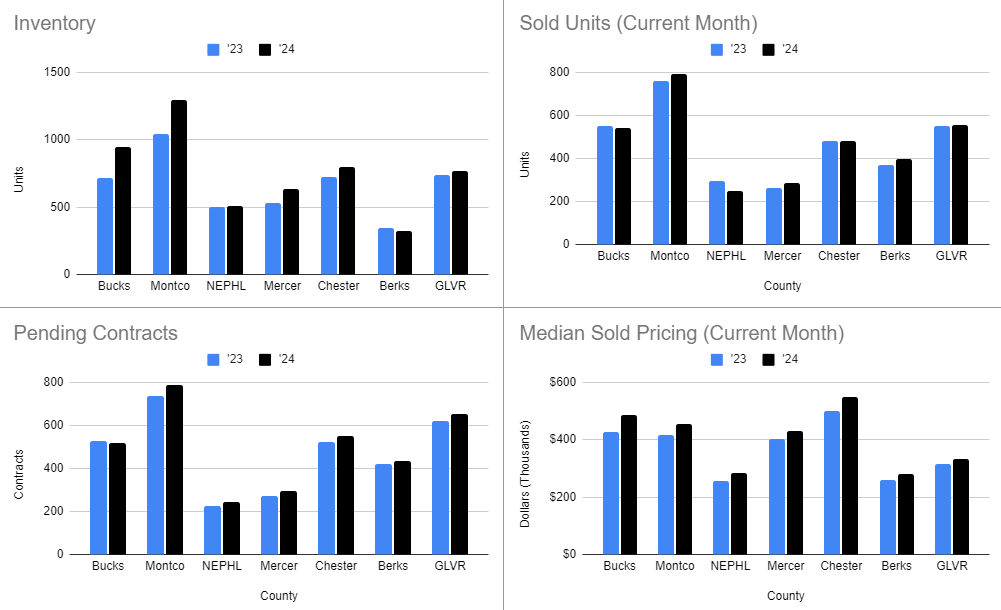

Local Real Estate Market Snapshot

Bucks County

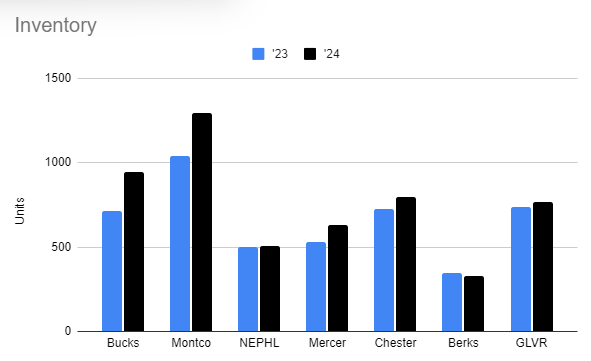

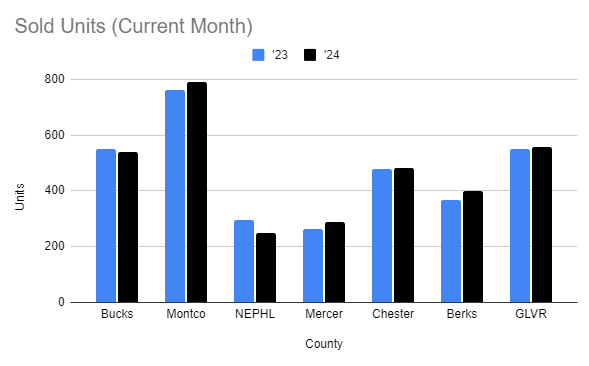

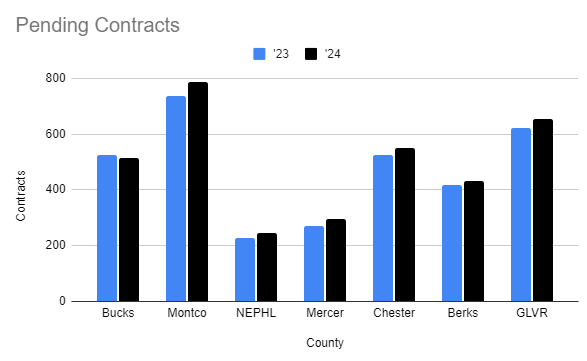

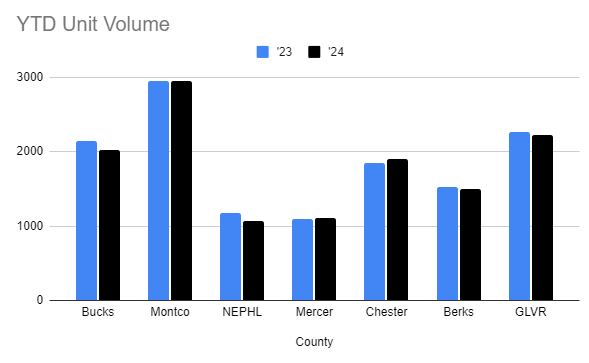

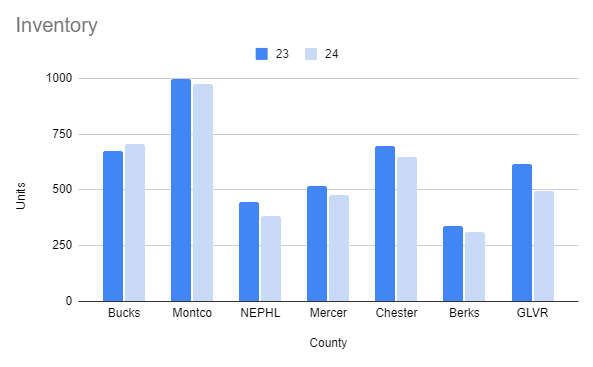

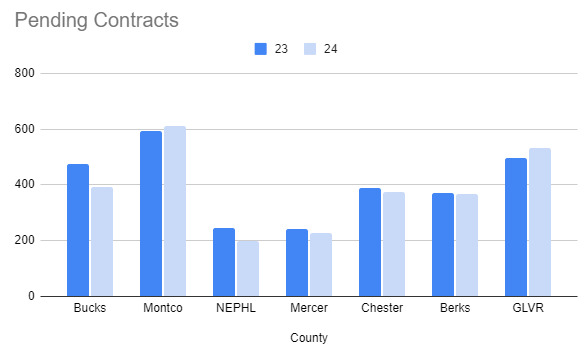

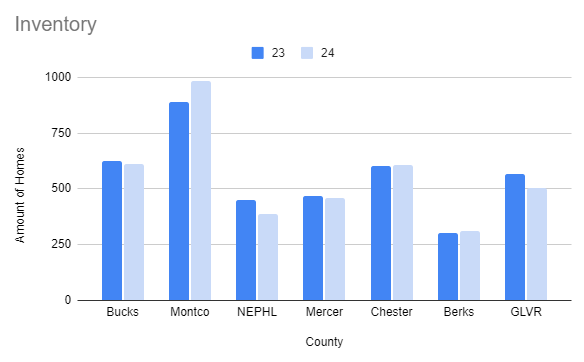

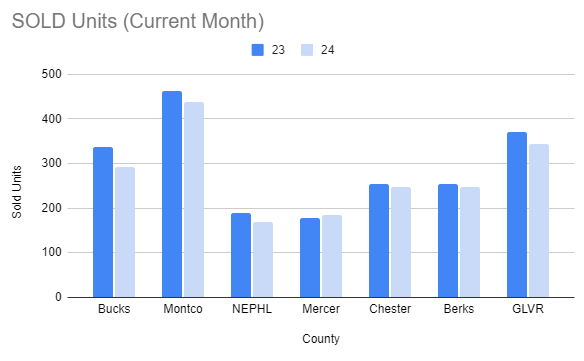

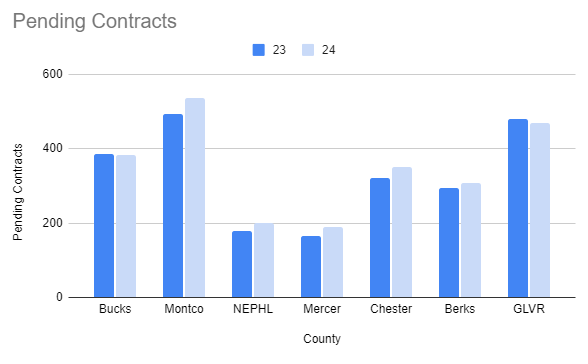

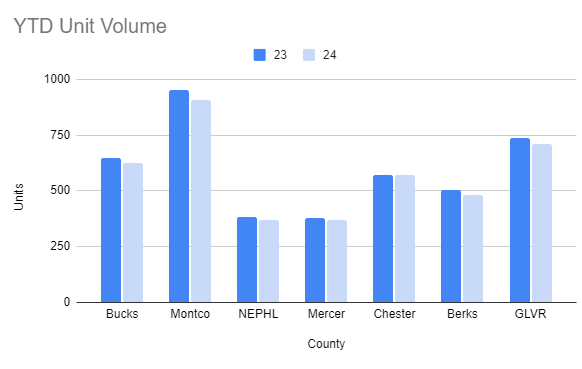

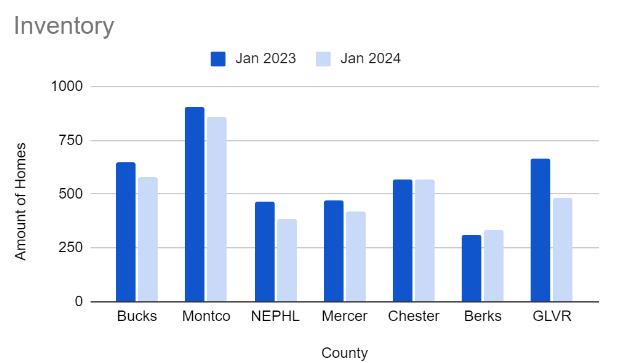

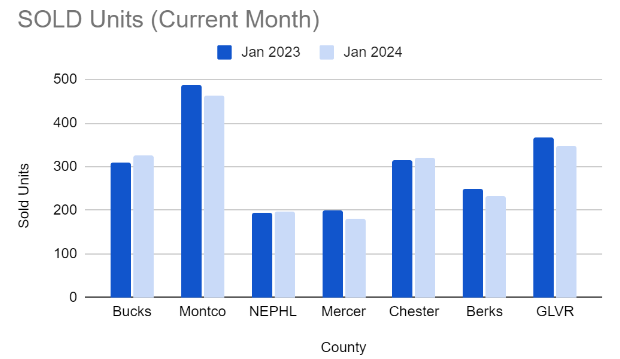

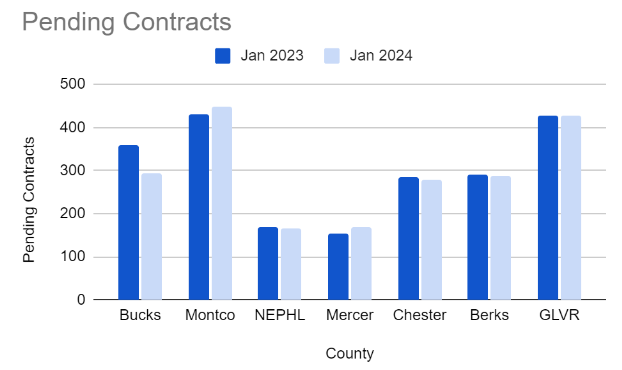

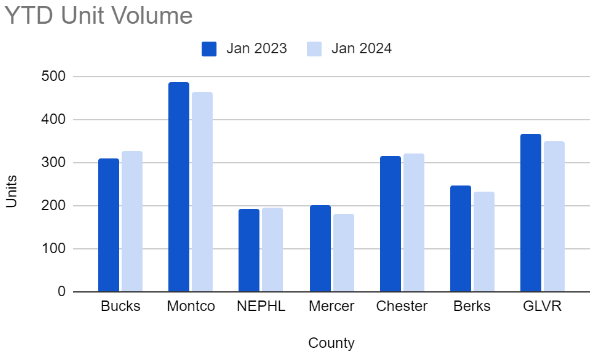

Bucks County has seen a significant increase in inventory, with a 36.5% rise year-over-year, bringing available homes to 980 in August 2024 compared to 718 in 2023. Despite more available homes, sold units dropped by 5.9%, with 603 homes sold. Pending contracts rose by 8.2%, signaling a potential increase in future sales.

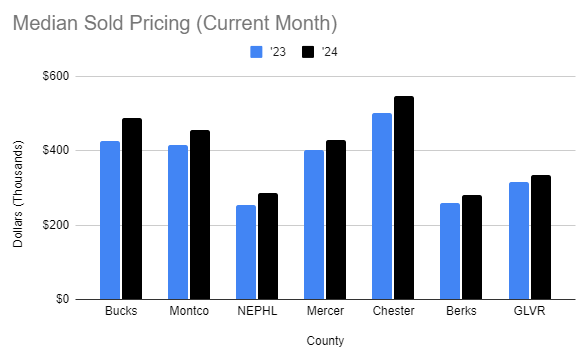

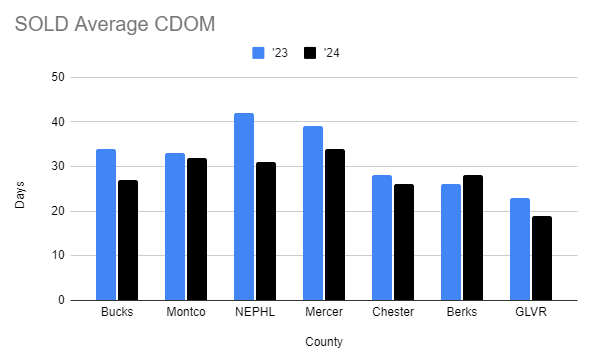

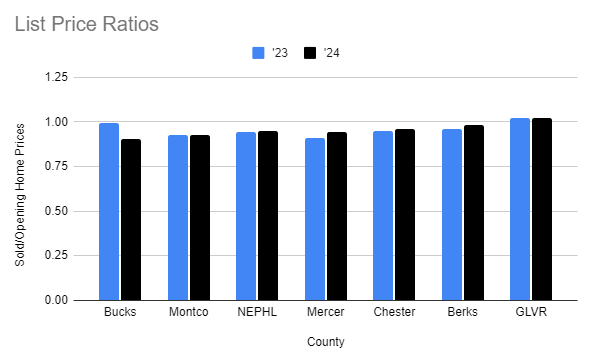

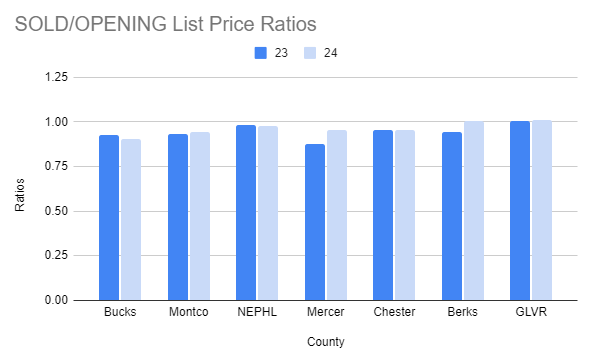

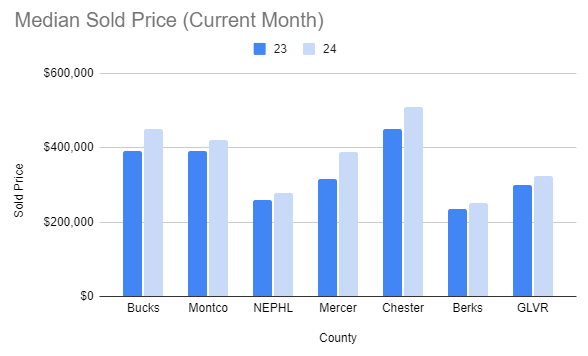

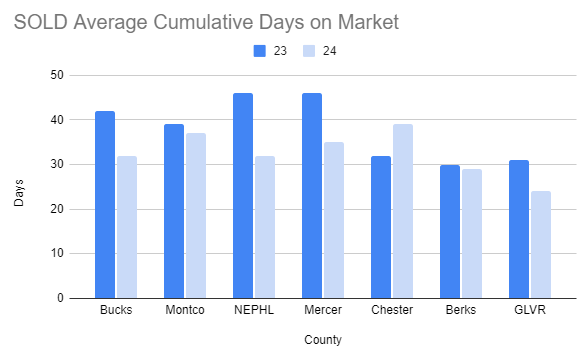

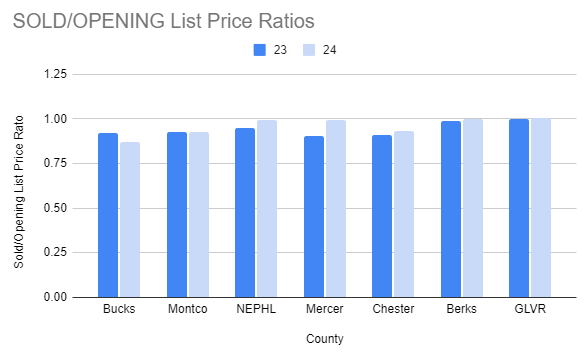

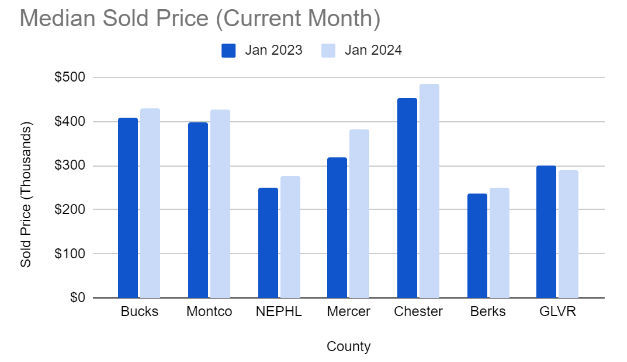

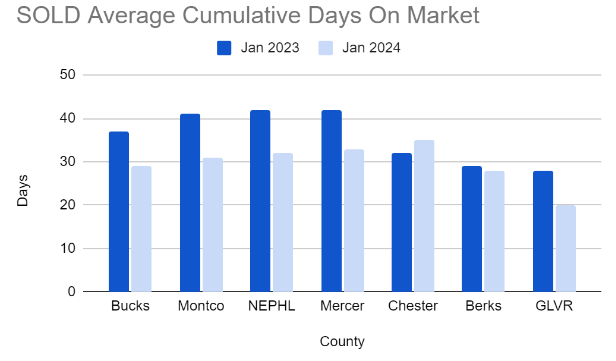

Median sold prices increased by 7.9%, now at $510,000. Homes are moving slightly faster with an average of 26 days on market (CDOM) compared to 28 last year, and sellers are getting close to their asking prices, with the list-to-sold price ratio at 96.0%, a slight drop from 97.2% in 2023.

Montgomery County (Montco)

Montgomery County experienced a 27.8% rise in inventory, reaching 1305 homes, alongside a 9.3% increase in sold units (897 homes). Pending contracts also saw a 2.1% uptick, showing a steady flow of buyer activity.

Median sold prices increased by 3.2%, now at $465,000, with homes taking slightly longer to sell at 30 days, up from 28. The sold-to-list price ratio dipped to 94.8% from 97.6%, reflecting slightly less seller leverage.

Chester County

In Chester County, inventory rose by 26.1% to 908 homes, though the number of sold units dropped by 8.1% to 569. Pending contracts decreased by 6.4%, indicating a slight slowdown in future sales.

Median home prices showed a small increase of 0.9% to $535,000. Homes sold in an average of 24 days, slightly faster than the previous year. The sold-to-list price ratio remained unchanged at 98.1%, indicating a stable seller’s market.

Berks County

Berks County reported a 4.8% increase in inventory, reaching 417 homes, with sold units rising by 2.5% to 410 homes. Pending contracts also rose by 3.1%, suggesting steady demand.

Home prices increased by 7.6% to $285,300. The average days on market increased slightly to 24 days, and the sold-to-list price ratio dropped to 98.2%, down from 100.0% last year.

Northeast Philadelphia (NEPHL)

NE Philadelphia saw a 12.4% increase in inventory, with 500 homes available, but a 5.0% decline in sold units to 247 homes. Pending contracts grew by 2.9%, indicating a potential increase in sales soon.

Median sold prices increased by 5.6% to $290,000. Homes are selling faster, with the average days on market dropping to 31 days from 36. The sold-to-list price ratio inched up to 96.6% from 96.4%.

Mercer County

Mercer County was a standout performer, with a 23.5% increase in inventory, reaching 689 homes. However, sold units decreased by 9.4% to 317 homes. Pending contracts showed strong growth, rising by 18.4%, signaling a potential uptick in future sales.

Home prices jumped by 10.0%, reaching a median of $467,000. Homes sold faster, with an average of 29 days on the market, and the sold-to-list price ratio improved to 98.9%, reflecting strong demand.

Greater Lehigh Valley Region (GLVR)

GLVR saw a 12.0% increase in inventory, with 768 homes available, but sold units declined by 9.7%. However, pending contracts rose by 7.9%, suggesting potential growth in sales.

The median sold price increased by 4.2% to $345,000, with homes taking an average of 16 days to sell. The sold-to-list price ratio remains strong at 101.1%, though it has dropped slightly from 102.4% in 2023.

Month-Over-Month Updates for Southern New Jersey Areas

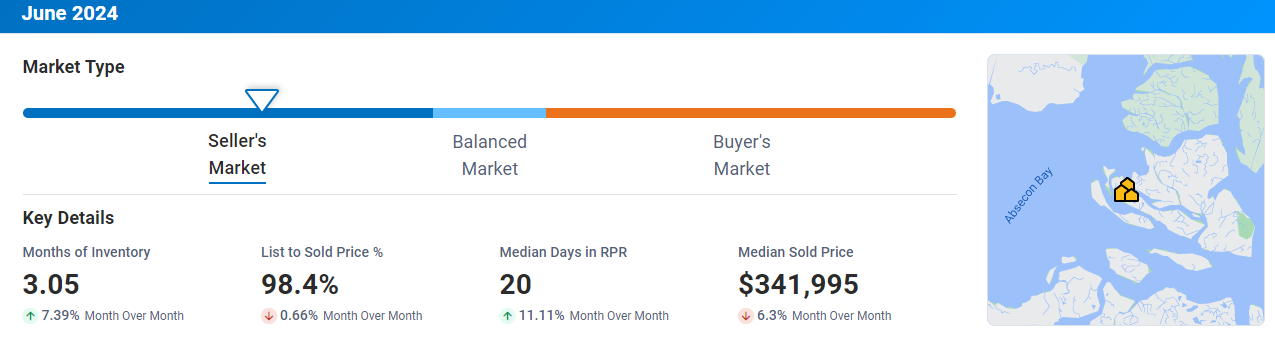

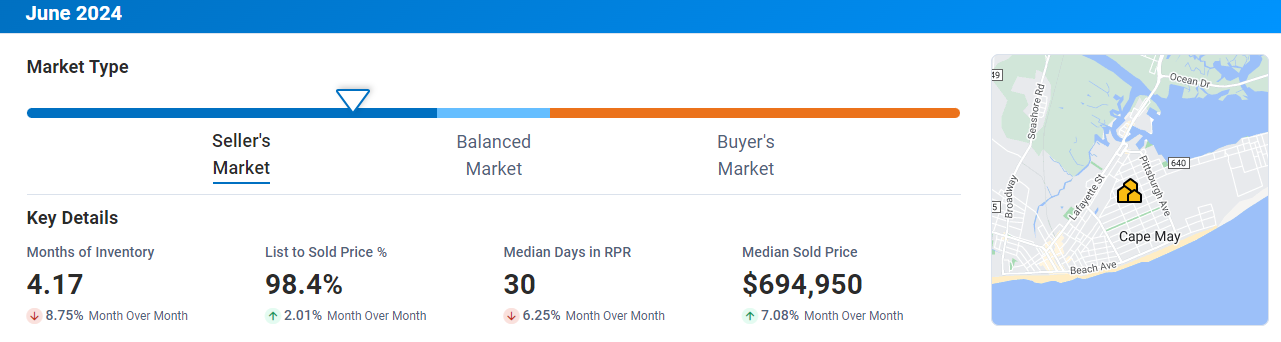

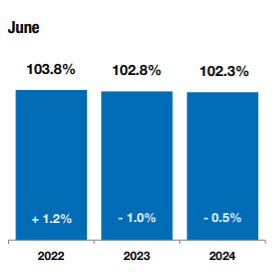

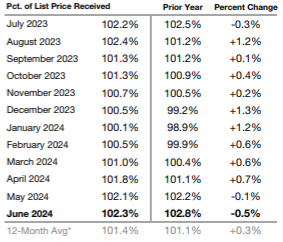

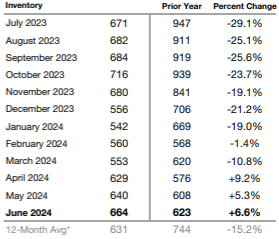

Cape May County, NJ

Cape May County’s market continues to heat up. The median sold price increased significantly by 29.92%, reaching $692,500 in August 2024. Homes sold jumped by 25%, with 30 homes sold compared to the previous month. Inventory also increased by 11.5%, with 97 active listings, giving buyers more options.

Homes are selling faster, with the average days on market (CDOM) dropping by 25% to 24 days. The list-to-sold price ratio improved to 98.4%, up by 1.55%, showing that sellers are receiving offers close to their asking prices.

Ocean County, NJ

In contrast, Ocean County saw a slight cooling. The median sold price dropped by 2.11%, settling at $465,000. The number of homes sold also decreased by 1.9%, with 858 homes sold in August 2024. Active listings experienced a significant decrease of 21.8%, bringing the total to 5,219 homes.

Homes are staying on the market slightly longer, with the average DOM increasing by 4% to 26 days. The list-to-sold price ratio dropped in line with median prices, reflecting a softening market.

Atlantic County, NJ

Atlantic County’s market showed a mix of positive and negative changes. The median sold price surged by 11.03% to $365,300, while the number of homes sold dipped by 1.1% to 271. Inventory increased by 5.6%, with 1,042 active listings.

Homes are taking longer to sell, with the average DOM rising by 13.04% to 26 days. Despite this, the list-to-sold price ratio improved to 99%, up by 0.72%, reflecting continued buyer interest.

Market Summary by Category

Across all these regions, there are a few key trends to note:

- Inventory: Inventory levels have generally increased in most areas, providing more options for buyers. The exception is Ocean County, where a significant drop in active listings was observed.

- Sold Units: Year-over-year trends showed declines in sold units across many regions, though some areas like Cape May and Montco posted monthly or annual increases.

- Median Sold Pricing: Price growth was a common theme across most markets, with the highest increase in Cape May County. Ocean County was the only exception, with a slight drop in median pricing.

- Days on Market: In most areas, homes are moving quickly, with some regions like Cape May and Mercer showing reduced DOM. Ocean and Atlantic Counties saw slight increases in selling times.

- List-to-Sold Price Ratio: While many regions reported slight declines in sold-to-list price ratios, several areas like Cape May, Atlantic County, and Mercer saw improvements, indicating continued demand.

These insights offer a comprehensive look at the real estate market across various counties in Pennsylvania and New Jersey as of August 2024, helping both buyers and sellers navigate a complex and shifting landscape.

Compare to last month’s market, HERE!

July 2024 Market Statistics

July 2024 Real Estate Market Update: Trends Across Pennsylvania and New Jersey

As we step into the second half of 2024, the real estate markets across several counties in Pennsylvania and New Jersey present a mixed bag of trends. From rising median prices to fluctuating inventory levels, here’s a detailed look at the performance across these regions for July 2024.

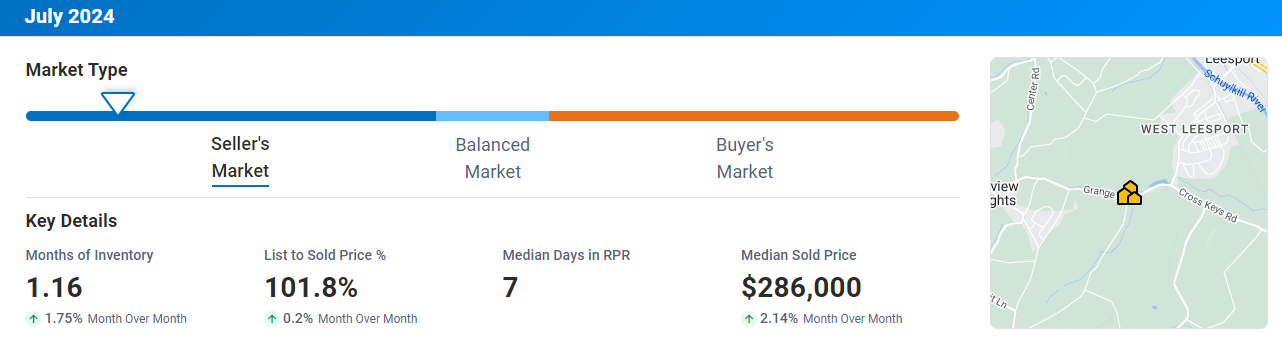

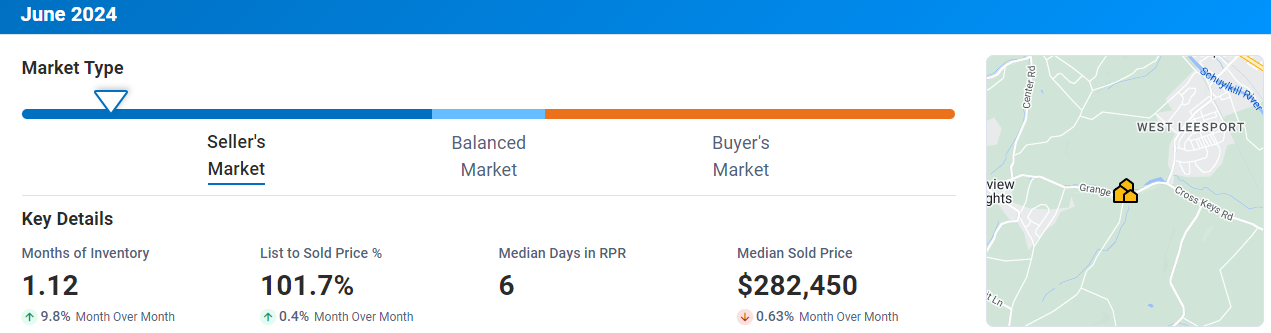

Berks County, PA

Berks County saw a modest increase in its median sold price, which climbed to $286,000, marking a 2.14% rise month-over-month (mo/mo). A total of 361 homes were sold, reflecting a 2.8% increase from the previous month. The number of active listings also grew, with 390 properties on the market, a 4% rise. Notably, homes in Berks County continue to sell quickly, with a median of just 7 days on the market. The list-to-sold price ratio is robust at 101.8%, up 0.2% mo/mo, indicating a strong seller’s market.

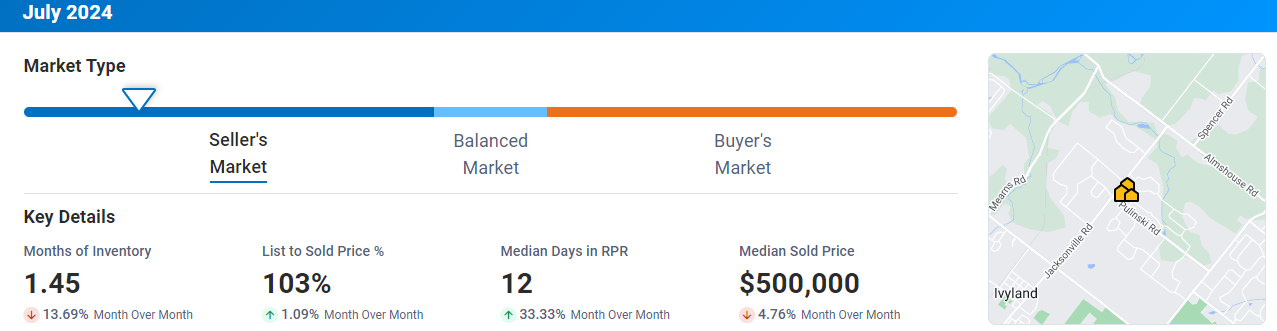

Bucks County, PA

Bucks County experienced a notable drop in its median sold price, which fell by 4.76% to $500,000. Despite this, the market remained active, with 599 homes sold—a significant 16.8% increase mo/mo. Active listings, however, declined by 12.5%, leaving 678 homes available. The median days in RPR increased to 12, a 33.33% jump. Sellers are still seeing high returns, with a list-to-sold price ratio of 103%, up 1.09% mo/mo.

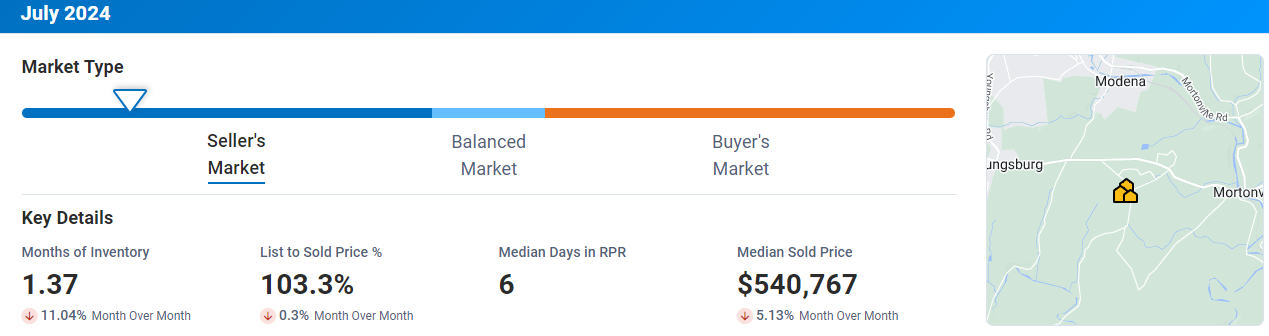

Chester County, PA

In Chester County, the market showed signs of cooling off. The median sold price decreased by 5.13% to $540,767, and the number of homes sold dropped by 10.9% to 540. Active listings fell by 9.2%, leaving 603 homes on the market. Despite these declines, homes are moving quickly, with a median of just 6 days on the market. The list-to-sold price ratio remains strong at 103.3%.

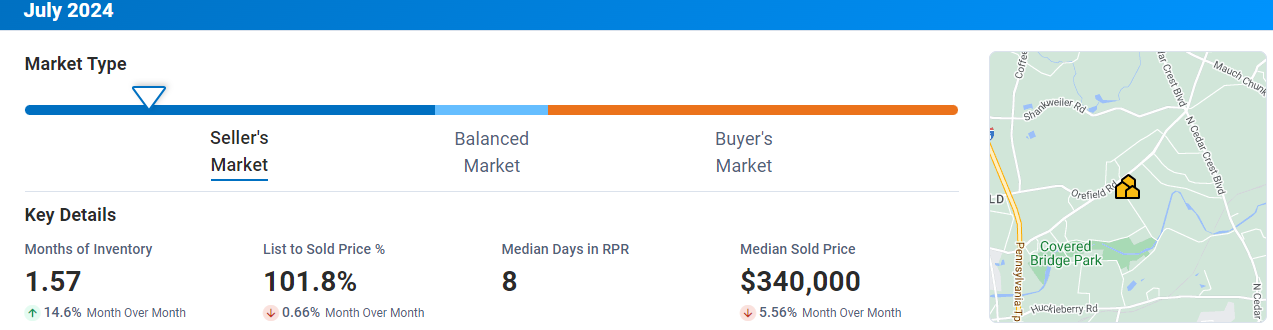

Lehigh Valley, PA

Lehigh Valley’s real estate market also saw a decline in July. The median sold price dropped by 5.56% to $340,000, with 337 homes sold, down 6.6% from the previous month. Active listings increased by 16.4%, bringing the total to 490. Homes spent a median of 8 days on the market, and the list-to-sold price ratio slightly decreased to 101.8%, down 0.66%.

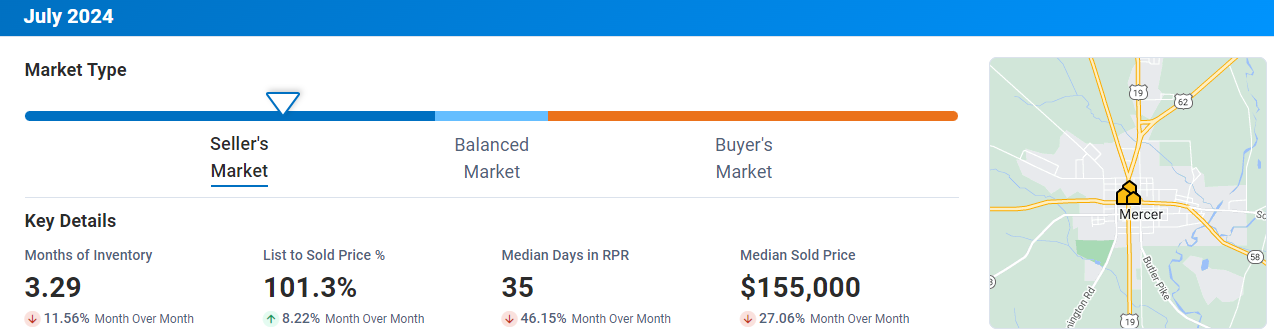

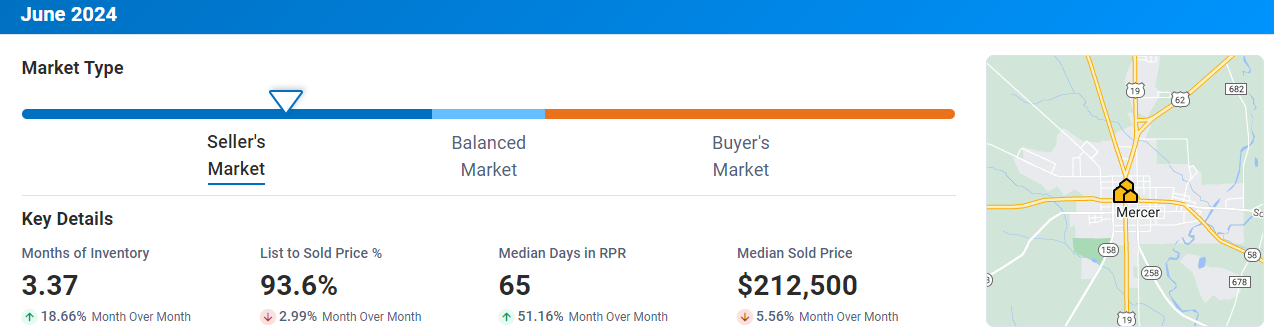

Mercer County, NJ

Mercer County faced a significant decline in its median sold price, plummeting by 27.06% to $155,000. However, the number of homes sold increased by 25% to 5. Active listings dropped by 14.8% to 23. The median days in RPR also fell sharply by 46.15%, now at 35 days. Despite the price drop, the list-to-sold price ratio surged by 8.22%, reaching 101.3%.

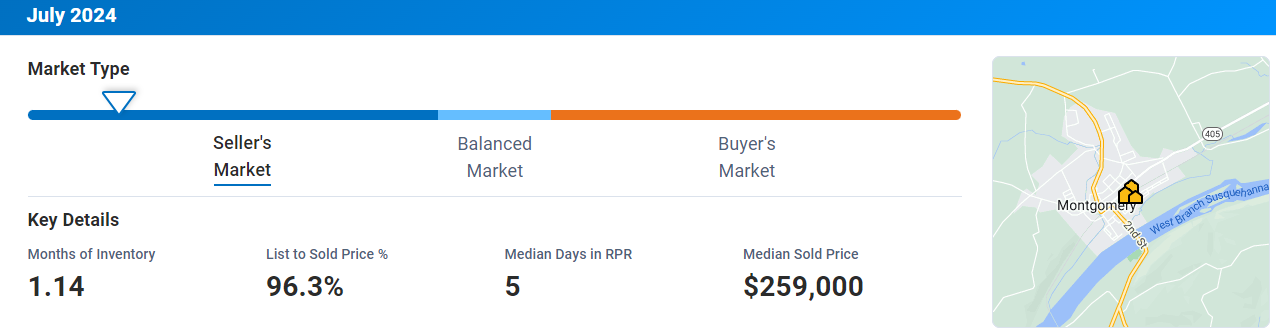

Montgomery County, PA

Montgomery County remained relatively stable, with a median sold price of $259,000. The number of homes sold jumped significantly by 150% to 5, while active listings stayed at 3. Homes sold quickly with a median of 5 days on the market, though the list-to-sold price ratio was 96.3%.

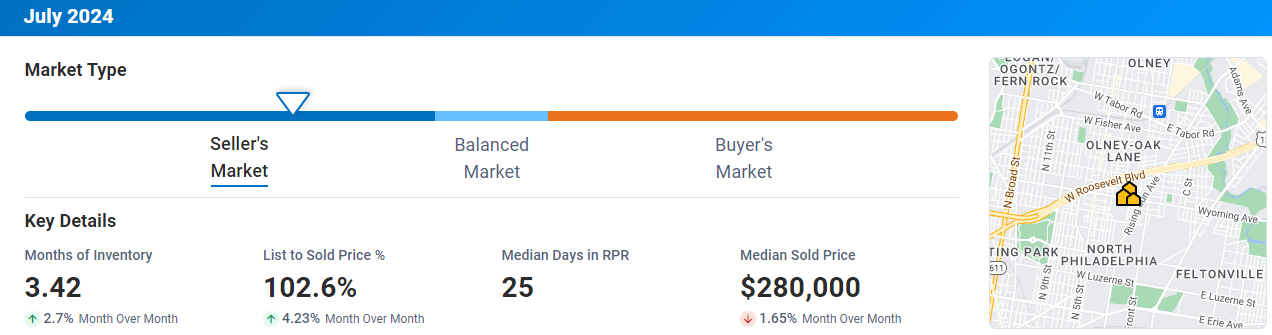

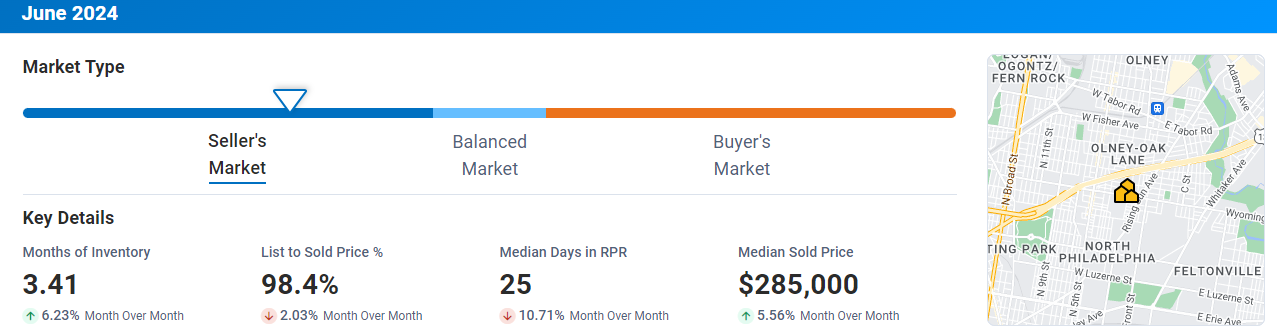

Philadelphia, PA

In Philadelphia, the median sold price slightly decreased by 1.65% to $280,000. The number of homes sold also saw a small decline of 1.5%, with 1,213 transactions. Active listings grew by 4.4% to 3,961. The median days in RPR stood at 25, and the list-to-sold price ratio increased by 4.23% to 102.6%, suggesting competitive bidding.

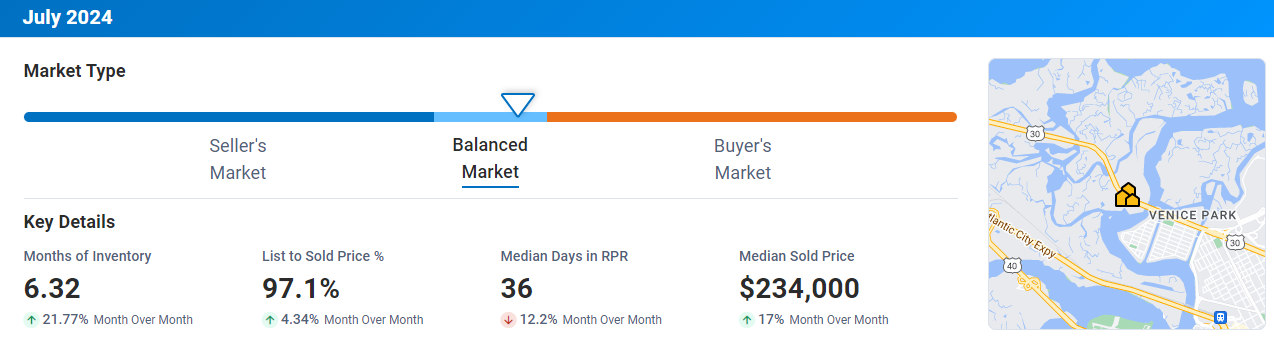

Atlantic County, NJ

Atlantic County experienced a strong increase in its median sold price, which rose by 17% to $234,000. However, the number of homes sold dropped by 40% to 21. Active listings rose by 15% to 238, while the median days in RPR decreased by 12.2% to 36 days. The list-to-sold price ratio also improved, up 4.34% to 97.1%.

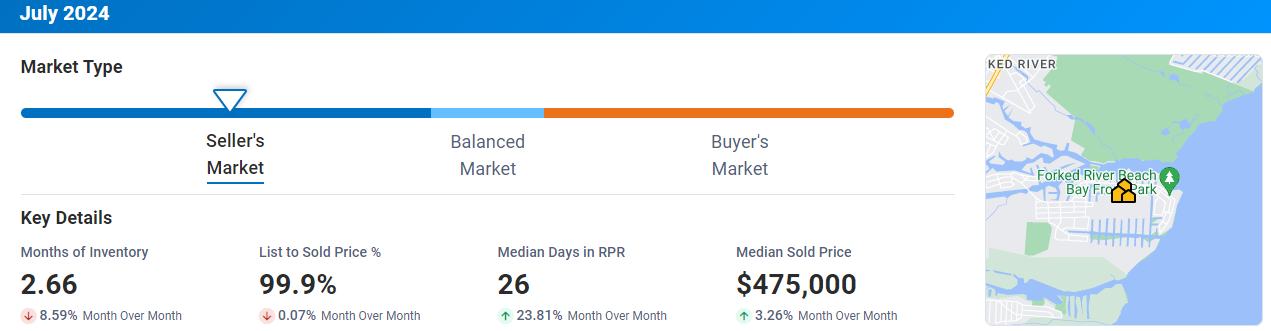

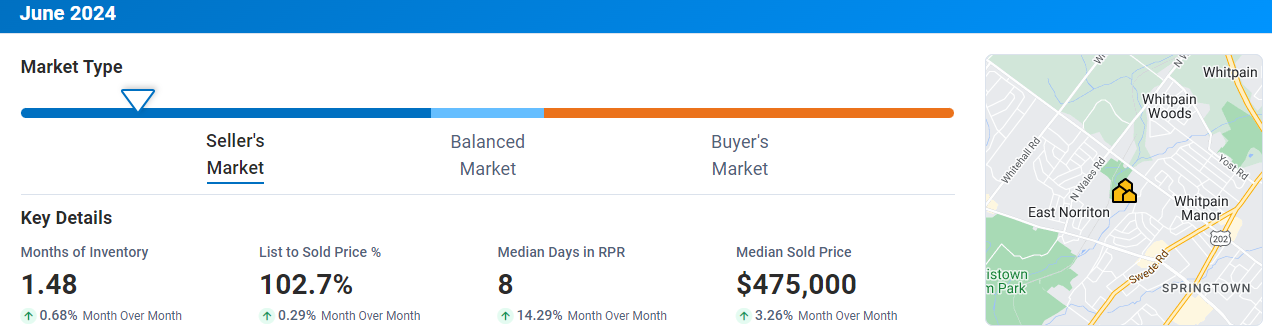

Ocean County, NJ

Ocean County’s market showed positive trends, with the median sold price increasing by 3.26% to $475,000. The number of homes sold went up by 6.5% to 847, while active listings fell by 7.2% to 2,202. The median days in RPR increased by 23.81% to 26 days. The list-to-sold price ratio slightly decreased by 0.07% to 99.9%.

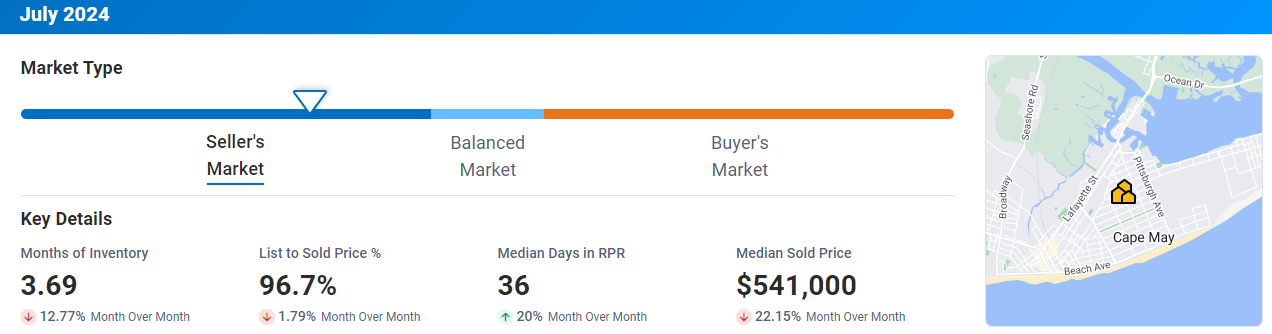

Cape May, NJ

Cape May saw a significant drop in its median sold price, which fell by 22.15% to $541,000. The number of homes sold also declined by 12.5% to 21. Active listings decreased by 8.8% to 83, and the median days in RPR increased by 20% to 36 days. The list-to-sold price ratio fell by 1.76% to 96.7%.

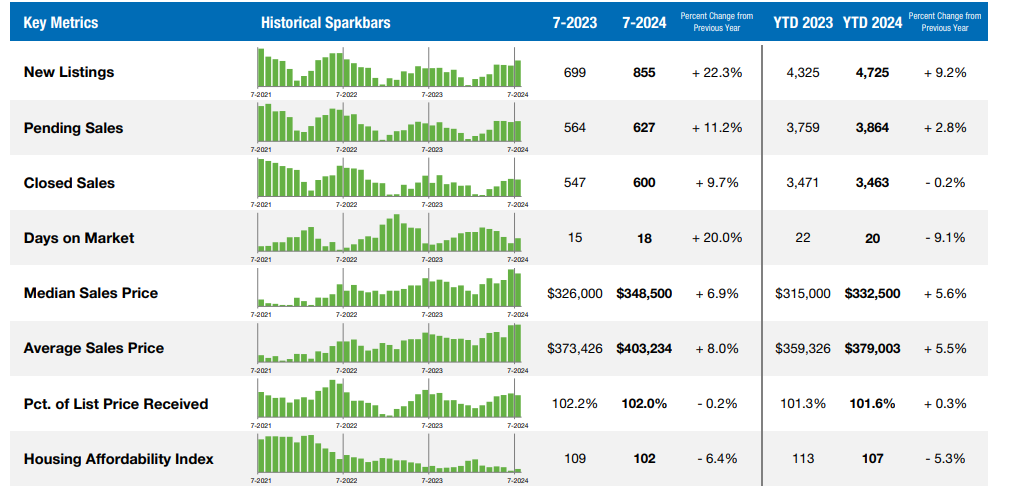

Greater Lehigh Valley REALTORS® (GLVR)

The GLVR market showed growth with a 6.9% increase in the median sold price, reaching $348,500. Homes sold went up by 9.7% to 600, and active listings surged by 19.3% to 802. The average days on the market rose by 20% to 18 days. The list-to-sold price ratio slightly decreased by 0.2% to 102%.

These figures highlight the dynamic nature of the real estate markets in Pennsylvania and New Jersey. While some areas are seeing price drops and slower sales, others continue to experience robust demand and quick turnovers. Keeping an eye on these trends will be crucial for both buyers and sellers in navigating the market as we progress through 2024.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link